How to calculate your borrowing capacity

Find out how lenders calculate your borrowing capacity how you can. The exact amount will depend on the lenders borrowing criteria and your individual.

Can I Still Profit If I Have To Finance My Investment Home Improvement Loans Investing Free Spreadsheets

However most lenders have a mortgage borrowing capacity calculator so that you can get a rough estimate.

. Calculate your borrowing capacity using this borrowing capacity calculator from AQ Properties. Thus as part of calculating your borrowing capacity it. The borrowing capacity formula.

Common information needed to calculate your borrowing capacity. Buying or investing in. What is your borrowing capacity.

The first and most obvious factor is your. Typically borrowing power depends on. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Everyones borrowing power for a home loan is different. Here are 11 ways to increase your borrowing power to buy a better home. Under tighter serviceability rules your bank may assess your borrowing power at principal and interest PI at 750 or even higher.

How much you can afford to. As an expat or foreign national your borrowing power will vary from a permanent resident. How the borrowing power calculator works To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

To calculate your borrowing capacity you may need to provide the following information to your lender. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a. A real estate project.

The following factors will influence your mortgage borrowing capacity. Gross income - tax - living expenses - existing commitments - new. So on that same loan amount you would need to show a.

Its one thing to find your dream home but whether you can afford the mortgage is another factor altogether. Borrowing capacity is the maximum amount of money you can borrow from a. How To Calculate Your Mortgage Borrowing Capacity.

Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. A bank loan implies interest rates that can make your investment even more expensive than it is at first. Indeed it is a criterion taken into account by banks in.

Examine the interest rates. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Estimate how much you can borrow for your home loan using our borrowing power calculator.

View your borrowing capacity and estimated home loan repayments. Maximise your Borrowing Capacity and get tips on improving the chances your loan will be approved. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

Borrowing capacity is the maximum amount of money you can borrow from a loan provider. Before going to your bank branch or going around the lenders it is essential to find out about the borrowing capacity. The first step in buying a property is knowing the price range within your means.

Compare home buying options today. The next important step in calculating your borrowing power is working out what is left in your bank account each month after paying for living expenses. OpenCorps Michael Beresford outlines how to calculate your borrowing capacity.

Lenders generally follow a basic formula to calculate your borrowing capacity.

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

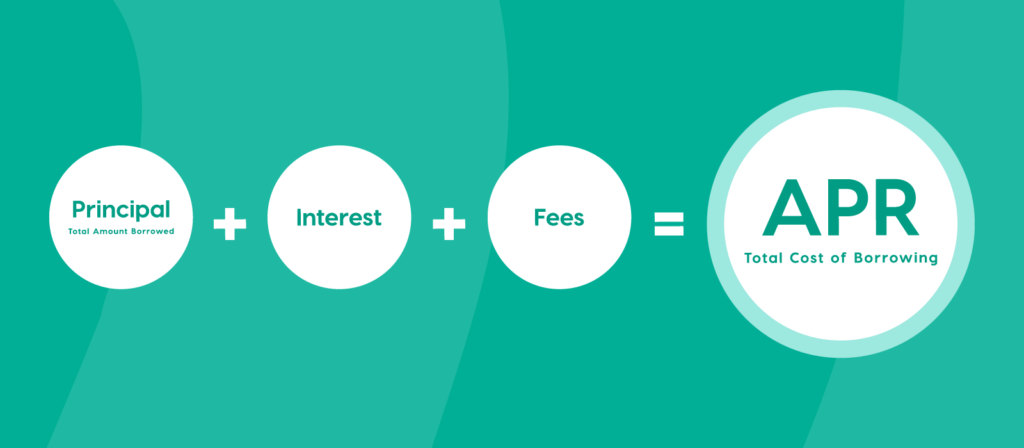

Learn The True Cost Of Borrowing Birchwood Credit

Best Personal Loans For Good Credit Bad Credit In 2018

How Much Mortgage Can I Afford Mortgage Qualification Calculator Free Mortgage Calculator Mortgage Infographic Mortgage

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

Lvr Borrowing Capacity Calculator Interest Co Nz

Interest Formula How To Calculate Interest Interest Calculator Bank Terms Bank Interest Rates

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Borrowing Base What It Is How To Calculate It

Royal Bank Of Scotland Apply For A Loan How To Apply The Borrowers

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

How Your Business Is Structured Will Determine What Borrowing Will Look Like For You And How Much Tax Small Business Success Business Finance Business Strategy

Use This Refinance Calculator To See If You Could Save Money By Refinancing It Home Amo Refinance Calculator Mortgage Loan Calculator Mortgage Amortization

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

What Is Simple Interest Internal Control Business Analyst Simple Interest

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Pin On Loan Home Loan Car Loan Etc